MEME COINS : Meme tokens in cryptocurrency are digital assets created primarily for entertainment or as a joke, often inspired by internet memes, pop culture, or viral trends. They are typically community-driven, relying on social media and online communities to generate hype and drive demand, rather than offering intrinsic technological or functional value. Examples like Dogecoin, Shiba Inu, and Floki Inu gained popularity through viral campaigns, endorsements from celebrities, and the power of meme culture. While meme tokens can experience significant price surges, they are highly speculative, volatile, and prone to rapid price swings, often influenced by trends or social media mentions. Investors should approach meme tokens with caution, as their value is more dependent on hype and community sentiment than on solid use cases or long-term sustainability.

Which are the two coins whose price is going to increase?

Actually, there are many such meme coins in cryptocurrency whose price has increased a lot, but today we are going to tell you about the two coins whose price is going to increase a lot in the coming few years, their names are GMX and ORCA coin.

GMX (GMX Coin) and ORCA (ORCA Coin) are both cryptocurrencies associated with decentralized finance (DeFi), but they operate on different blockchains and focus on distinct aspects of the DeFi ecosystem. Here’s a brief overview of both:

GMX (GMX Coin):

- Overview: GMX is a decentralized exchange (DEX) primarily focused on providing spot and perpetual (leveraged) trading. It operates on Arbitrum and Avalanche, both of which are Layer-2 scaling solutions designed to improve Ethereum’s transaction speed and reduce costs.

- Functionality: GMX allows users to trade with leverage (up to 30x) in a decentralized manner, meaning they don’t need to rely on a central authority like traditional exchanges. Users can also earn fees by staking GMX tokens or liquidity in the GMX ecosystem.

- Utility of GMX Token: The GMX token is used for governance, meaning holders can vote on protocol upgrades and other decisions. Additionally, staking GMX allows users to earn a share of the fees generated by the platform.

- Key Features:

- Spot & Perpetual Markets: Offers both spot trading and leveraged perpetual contracts.

- Liquidity Providers: Users who provide liquidity to GMX can earn fees, incentivizing participation.

- Governance: GMX token holders participate in the governance of the platform.

- Low Fees: Since it’s built on Arbitrum and Avalanche, it benefits from lower transaction costs and faster speeds compared to Ethereum’s mainnet.

ORCA (ORCA Coin):

- Overview: It is designed to provide a fast and user-friendly trading experience with lower transaction fees compared to other blockchain networks like Ethereum.

- Functionality: ORCA enables users to trade tokens in a decentralized manner, providing liquidity and offering low fees for users. It’s a part of the growing Solana DeFi ecosystem, which is known for its high throughput and scalability.

- Utility of ORCA Token: The ORCA token is primarily used for governance and staking. Token holders can vote on changes and proposals for the platform, and users who stake ORCA can earn rewards.

- Key Features:

- Solana-Based: Built on the Solana blockchain, ORCA benefits from Solana’s fast transaction speeds and low fees.

- User-Friendly Interface: ORCA focuses on a clean and intuitive interface, making it more accessible to both beginner and advanced users.

- AMM Model: It uses an Automated Market Maker (AMM) model, which allows for decentralized and permissionless trading of tokens.

- Low Fees: Solana’s network enables low-cost transactions, making ORCA a competitive DEX in the space.

Comparison:

- Blockchains: GMX operates on Arbitrum and Avalanche (both Layer-2 and Layer-1 scaling solutions for Ethereum), while ORCA is built on the Solana blockchain, known for its high speed and low transaction costs.

- Target Markets: GMX focuses on providing leveraged trading through both spot and perpetual markets, while ORCA is a simpler AMM DEX aimed at providing low-fee token trading and liquidity provision.

- User Experience: ORCA offers a more straightforward and user-friendly experience, while GMX, with its leveraged trading options, is likely to attract more experienced traders.

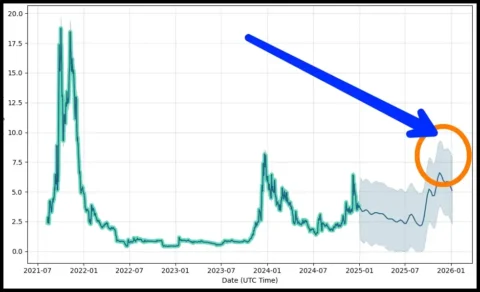

GMX and ORCA Coin Predictions

However, I can share general insights based on recent trends and typical factors that could influence GMX and ORCA coins:

- GMX Coin (GMX):

- GMX is a decentralized spot and perpetual exchange on Arbitrum and Avalanche, providing a platform for trading and earning fees.

- The price movement of GMX could depend on the adoption and growth of decentralized finance (DeFi) ecosystems, particularly on networks like Arbitrum and Avalanche.

- Factors such as new partnerships, platform updates, and developments in DeFi governance could also play a role in its price.

- ORCA Coin (ORCA):

- ORCA is a decentralized exchange (DEX) built on Solana, focusing on fast transactions and a user-friendly interface.

- The future of ORCA might be tied to the performance and growth of the Solana blockchain. As Solana continues to improve and expand, ORCA’s value could benefit from this.

- Like other altcoins, ORCA’s price may also be affected by the overall crypto market trends, regulatory changes, and the platform’s ability to innovate in a competitive space.

In both cases, the general state of the crypto market (bullish or bearish trends) will have a significant impact. Keep in mind that cryptocurrencies can be volatile, and price predictions are speculative, so it’s important to stay updated with news and market trends.

History of GMX and ORCA coins

History of GMX (GMX Coin):

GMX is a decentralized exchange (DEX) platform that enables spot and perpetual trading on the Arbitrum and Avalanche blockchains. Its history is closely tied to the rise of decentralized finance (DeFi) and Layer-2 scaling solutions, which aim to solve Ethereum’s scalability issues.

- Launch: GMX was launched in 2021. It quickly became popular due to its focus on perpetual contracts, a type of derivative product that allows users to trade assets with leverage. The protocol allows users to trade without a centralized authority, giving it a decentralized nature.

- Platform Development: GMX’s focus on leveraging Layer-2 solutions, such as Arbitrum and Avalanche, was key to its success. These networks provided faster transaction speeds and lower fees compared to Ethereum’s mainnet, which are essential for trading at scale. This gave GMX a significant advantage in terms of cost and speed, particularly for traders who sought alternatives to Ethereum-based exchanges.

- GMX Token Launch: The GMX token was introduced as the governance token for the platform, giving holders a say in the future of the protocol. In addition to governance, the GMX token is used to earn a share of trading fees by staking the token or liquidity within the GMX ecosystem.

- Growth and Adoption: The decentralized nature of GMX, combined with its innovative features such as staking rewards and its ability to provide liquidity to spot and perpetual markets, contributed to its rapid growth. As decentralized trading grew in popularity, GMX became one of the more recognized players in the space, attracting more liquidity providers and traders.

- Recent Developments: Over time, GMX has continued to expand its ecosystem, offering more tools for users to interact with the platform. As of 2023, GMX had established itself as a key DeFi exchange, building partnerships and growing its community of traders and liquidity providers.

History of ORCA (ORCA Coin):

ORCA is a decentralized exchange (DEX) built on the Solana blockchain, designed to offer fast and low-cost token swaps with a focus on a simple and user-friendly interface. ORCA is part of the larger Solana DeFi ecosystem, which is known for its high scalability and low transaction fees.

- Launch: ORCA was launched in 2021 as one of the early decentralized exchange protocols on the Solana blockchain. The Solana network, known for its fast transaction speeds and low fees, made it an attractive platform for decentralized finance (DeFi) projects, and ORCA aimed to leverage these features to offer a superior trading experience.

- Platform Design: ORCA’s design is based on the Automated Market Maker (AMM) model, which allows for decentralized and permissionless trading of tokens. The AMM model enables users to trade against liquidity pools rather than a traditional order book, helping to eliminate the need for intermediaries. ORCA focused on being a simple, efficient, and user-friendly platform for users of all experience levels.

- Community and Growth: ORCA gained attention for its focus on a clean, intuitive user interface and its emphasis on providing low-fee transactions, a core advantage of Solana’s blockchain. The project aimed to cater to both experienced crypto traders and newcomers, with an easy-to-navigate platform and lower barriers to entry compared to more complex DeFi platforms.

- ORCA Token: The ORCA token serves multiple purposes within the platform, including governance and staking. ORCA holders can participate in decision-making processes regarding protocol upgrades and features. Additionally, stakers can earn rewards from the platform’s activity.

- Partnerships and Integrations: ORCA, as a key project on Solana, benefits from the growing adoption of Solana and its ecosystem. It also collaborated with other Solana-based projects to increase liquidity and use cases. Over time, ORCA has become one of the top decentralized exchanges on Solana, competing with other AMM platforms like Raydium.

- Recent Developments: ORCA’s development has focused on optimizing the trading experience on Solana, especially with low transaction costs and high throughput. The platform continues to innovate, improving liquidity and increasing its share in the competitive Solana DeFi space.

Comparison of GMX and ORCA’s Histories:

- Launch Dates: Both GMX and ORCA launched in 2021, capitalizing on the rapid growth of decentralized finance during that time.

- Blockchains: GMX operates on Arbitrum and Avalanche, which are both Layer-2 and Layer-1 scaling solutions for Ethereum. ORCA, on the other hand, is built on Solana, which is known for its high-speed and low-cost transactions.

- Focus: GMX has positioned itself as a perpetual trading platform with leverage, aiming to cater to more experienced traders. ORCA, however, is designed for simple, low-fee token swaps, with a focus on user experience and accessibility.

- Token Utility: Both GMX and ORCA use their native tokens for governance, but GMX also focuses on staking rewards through the liquidity pools and trading fees, while ORCA’s token is used mainly for governance and staking rewards.

Both coins have successfully tapped into the growing demand for DeFi services, offering their own unique features to attract users within their respective ecosystems.

How much can the price of GMX and ORCA coins increase?

The potential price increases for GMX and ORCA coins depend on various factors, including their platform adoption, the broader cryptocurrency market trends, and the growth of their respective ecosystems. While it’s difficult to predict precise price movements, we can assess the factors that could drive their growth and influence their future price potential:

Factors Influencing GMX Coin Price Increase:

- Adoption of Decentralized Finance (DeFi):

- GMX is a decentralized exchange (DEX) that operates on Arbitrum and Avalanche, both Layer-2 solutions for Ethereum and scalable blockchains. If DeFi continues to grow in the coming years, particularly in the areas of perpetual trading and liquidity provision, GMX could see significant demand.

- As more users and liquidity providers join the GMX ecosystem, the demand for GMX tokens (which are used for governance and fee-sharing) could increase, potentially driving its price upward.

- Leverage Trading:

- GMX’s ability to offer perpetual contracts with leverage attracts traders looking for more advanced trading tools. If GMX continues to capture more market share in leveraged and spot trading, it could become a dominant player, which might lead to price appreciation.

- Market Sentiment and Crypto Bull Runs:

- GMX’s price could rise significantly during bull markets in the broader crypto space, as DeFi platforms tend to perform well when overall crypto market sentiment is positive. This could result in increased trading volume on the platform and higher demand for GMX tokens.

- Governance and Staking:

- The GMX token’s use in governance and staking can help increase its demand as more users get involved in the protocol’s decisions and liquidity pools. Staking GMX for fee-sharing incentives can also drive long-term demand for the token.

- Expansion and Partnerships:

- GMX’s growth and adoption depend on its ability to form strategic partnerships, expand to other blockchains, and continually innovate. If GMX integrates new features or collaborates with other projects, it could attract more users, potentially leading to a price increase.

Potential for Price Increase: GMX could see its price grow significantly if it continues to capture DeFi market share, particularly in leveraged trading. Depending on broader market conditions, GMX might see its price double or more in the coming years, but such a prediction would remain speculative and depend heavily on the factors mentioned.

Factors Influencing ORCA Coin Price Increase:

- Growth of Solana Blockchain:

- If Solana continues to grow in popularity and attracts more users and developers to its ecosystem, ORCA stands to benefit from this growth.

- As more projects build on Solana, ORCA could capture more trading volume, potentially leading to higher demand for ORCA tokens and price increases.

- DeFi and DEX Adoption:

- ORCA is a decentralized exchange focused on providing low-fee token swaps. As more users turn to decentralized exchanges for trading, ORCA could see increased volume and adoption. This could drive higher demand for ORCA tokens, especially if its ecosystem continues to develop.

- The growing trend of DeFi liquidity farming and yield farming could further incentivize users to participate in ORCA’s liquidity pools, raising demand for ORCA tokens.

- User Experience and Innovation:

- ORCA has gained attention for its user-friendly interface, which differentiates it from other DEXs. If it continues to innovate and improve its platform, it could attract more users, further boosting demand for ORCA tokens.

- Integrating additional features like staking, yield farming, and governance options could also add value to the token and drive its price up.

- Network Effects on Solana:

- Solana’s increasing use in the broader blockchain space will likely have a positive effect on ORCA, as it is one of the leading DEXs on Solana. If Solana continues to gain traction, ORCA could see a surge in its user base, which could translate into higher prices for its token.

- Broader Crypto Market Movements:

- Like all cryptocurrencies, ORCA’s price will also be influenced by the overall market sentiment in the crypto space. If the market experiences a bullish phase, DEXs like ORCA could see significant price increases, especially if there is high demand for DeFi services.

Potential for Price Increase: The price of ORCA could increase significantly if Solana continues to grow and if ORCA solidifies its position as a leading decentralized exchange on the network. Given the scalability and low-fee advantages of Solana, ORCA’s price could rise, but this would depend on Solana’s ecosystem expanding, continued adoption of decentralized exchanges, and ORCA’s ability to innovate.

What things should be kept in mind while investing in GMX and ORCA coin?

When considering investing in GMX and ORCA coins, it’s essential to keep a few key factors in mind to make informed decisions. Here are the critical aspects to consider:

1. Understand the Project Fundamentals

- GMX: GMX is a decentralized exchange. It operates on Arbitrum and Avalanche, both of which are Layer-2 scaling solutions that provide faster and cheaper transactions than Ethereum’s mainnet.

- ORCA: ORCA is a Solana-based DEX designed to offer fast, low-fee token swaps and a user-friendly experience. The Solana network’s scalability and speed are key drivers for ORCA’s performance.

Key takeaway: Understand how each project fits into the broader DeFi ecosystem. GMX focuses more on advanced trading tools, while ORCA aims for simplicity and lower fees, focusing on a wide range of users.

2. Evaluate the Ecosystem and Adoption

- GMX: GMX’s success is tied to the adoption of Arbitrum and Avalanche, and their ability to scale Ethereum. As both platforms continue to grow, GMX could benefit from increased traffic and liquidity. Also, assess whether GMX can capture market share in perpetual trading and advanced DeFi services.

- ORCA: ORCA’s growth is tied to the success of the Solana blockchain. If Solana maintains its momentum and attracts more developers and users, ORCA could gain significant market share.

Key takeaway: Look at the growth potential of the ecosystems these coins are built on. If Solana and Avalanche/Arbitrum continue to expand, both GMX and ORCA could benefit.

3. Platform Usage and Token Utility

- GMX: The GMX token is primarily used for governance and staking to earn a share of the fees generated by the platform. Investors should assess whether GMX has a solid model for incentivizing token holders and if staking rewards align with their investment goals.

- ORCA: The ORCA token is used for governance and staking as well. Evaluate how much governance control token holders have, and what incentives exist for holding ORCA tokens (e.g., staking rewards, liquidity mining).

Key takeaway: Assess whether the token utility supports long-term value. Staking and governance incentives can be attractive, but you should understand how the projects distribute rewards and manage token inflation.

4. Liquidity and Trading Volume

- GMX: The liquidity and trading volume on GMX will impact the effectiveness of the platform and its token price. High trading volume can result in more fees, making staking more rewarding for token holders.

- ORCA: Similar to GMX, ORCA’s liquidity pools and trading volume on the Solana network will influence its token value. Evaluate how much liquidity is in the ORCA pools and whether it is growing.

Key takeaway: Higher liquidity generally supports better token price stability and stronger user adoption. Check current liquidity and volume trends on both platforms.

5. Regulatory and Market Risk

- GMX & ORCA: Both GMX and ORCA operate in the DeFi space, which is relatively unregulated compared to traditional financial markets. Changes in regulatory landscapes, particularly in major markets like the U.S. or Europe, can impact the viability of DeFi platforms. Ensure you understand the regulatory risks associated with investing in these tokens.

Key takeaway: Regulatory uncertainty can lead to price volatility or even platform restrictions. Stay informed about the regulatory landscape for cryptocurrencies, especially for DeFi projects.

6. Market Volatility

- GMX & ORCA: Both tokens, like most cryptocurrencies, are subject to high volatility. DeFi-related tokens can be even more volatile due to their reliance on market trends and speculative trading. Pay attention to broader market conditions, as a crypto bear market or regulatory crackdown could negatively impact both coins.

Key takeaway: Understand the inherent volatility of crypto investments. Be prepared for the price to fluctuate significantly, and only invest what you can afford to lose.

7. Technological Risks

- GMX: Evaluate the technological development of GMX, including smart contract security and the team’s ability to maintain and improve the platform. While GMX operates on well-established Layer-2 networks, any vulnerabilities in its smart contracts could lead to issues for investors.

- ORCA: Similarly, Solana has faced network outages and performance issues in the past. While Solana’s high throughput is a key advantage, any future technical failures or network downtime could affect ORCA’s liquidity and platform performance.

Key takeaway: Both GMX and ORCA depend on the technical reliability of their respective blockchains and smart contracts. Look into the projects’ security audits and the development team’s history of delivering improvements.

8. Tokenomics and Inflation

- GMX: The supply and distribution of GMX tokens are important factors in its long-term value. Look into how many GMX tokens are circulating and the inflation rate of the token supply. A limited supply with steady demand could lead to price increases.

- ORCA: Similarly, ORCA’s circulating supply and inflation mechanism will affect its price. A high inflation rate can dilute token value, so understanding how the project manages its supply is crucial.

Key takeaway: Assess the tokenomics (supply model and inflation rate) for both GMX and ORCA. A token with well-managed supply dynamics is more likely to experience sustainable growth.

9. Community and Development Team

- GMX: The community and development team behind GMX play a crucial role in its growth and sustainability. A strong community can drive governance decisions and liquidity provision. Additionally, check how active and capable the development team is at iterating and improving the platform.

- ORCA: Similarly, ORCA’s success is dependent on its community and development team. A growing and engaged community will help with liquidity and governance, while a capable team ensures the platform evolves and remains competitive.

Key takeaway: A strong, active community and a transparent, capable development team are crucial for the long-term success of any cryptocurrency project.

10. Diversification and Risk Management

- GMX & ORCA: As with any investment, diversifying your portfolio is essential to manage risk. Holding large amounts of a single DeFi token could expose you to high levels of risk, particularly if one platform underperforms or faces issues.

Key takeaway: Don’t invest all your capital in GMX or ORCA alone. Consider diversifying across multiple assets to mitigate risks, especially in the highly volatile crypto market.

How to invest in GMX and ORCA coins

Investing in GMX (GMX Coin) and ORCA (ORCA Coin) requires understanding how to buy these tokens and the platforms available to facilitate these transactions.

1. Choose a Reliable Exchange or Platform

You can purchase both GMX and ORCA coins on various cryptocurrency exchanges, but you’ll need to select the right one based on the supported trading pairs and networks. Here’s how to do it for both tokens:

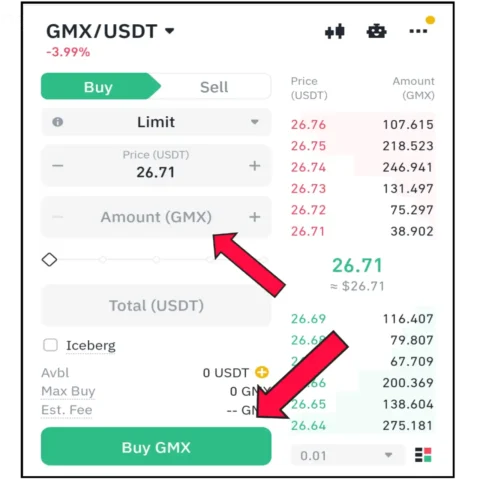

How to Invest in GMX (GMX Coin):

1. Find a Platform that Supports GMX

- Centralized Exchanges: GMX is available on centralized exchanges (CEXs) like Binance, KuCoin, and FTX (if available in your region).

- Decentralized Exchanges (DEXs): If you prefer a decentralized approach, you can also trade GMX on Uniswap (for Arbitrum) or Trader Joe (on Avalanche) through MetaMask or other Web3 wallets.

2. Create an Account

- If you’re using a centralized exchange like Binance or KuCoin, you’ll need to create an account. Make sure to complete the verification process if required.

- If you’re using a decentralized exchange (DEX), you’ll need a Web3 wallet such as MetaMask or Trust Wallet.

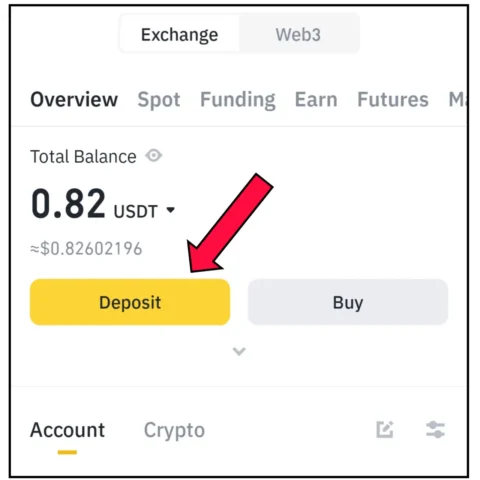

3. Deposit Funds

- Centralized Exchange: Deposit fiat currency (such as USD or EUR) using your bank card or transfer cryptocurrency like Bitcoin (BTC) or Ethereum (ETH) to fund your account.

- Web3 Wallet: If you’re using a decentralized exchange, transfer Ethereum (ETH) or stablecoins (like USDC or DAI) to your Web3 wallet.

4. Buy GMX

- Once your account is funded, search for GMX/USDT or GMX/ETH trading pairs on a centralized exchange.

- On decentralized exchanges, you will need to connect your wallet (such as MetaMask) and swap your Ethereum or stablecoin for GMX.

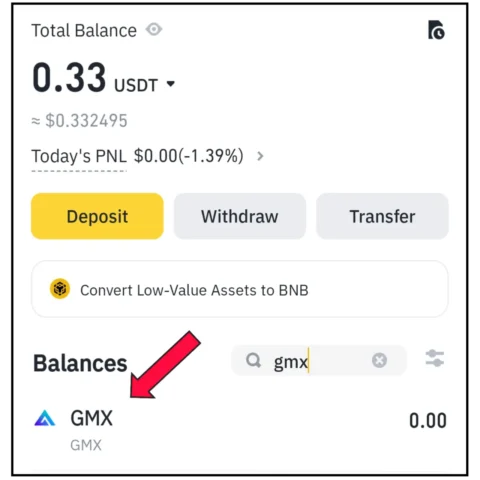

5. Store Your GMX Tokens

- You can store GMX on the exchange (but it’s safer to transfer it to your own wallet).

- Consider using a hardware wallet like Ledger or Trezor for enhanced security if you plan to hold GMX long-term.

How to Invest in ORCA (ORCA Coin):

1. Find a Platform that Supports ORCA

- Centralized Exchanges: ORCA is available on Binance, FTX, and Gate.io. Choose a platform that supports your region.

- Decentralized Exchanges (DEXs): You can also purchase ORCA on Raydium or Serum, two DEXs on the Solana network, using a Solana-compatible wallet (like Phantom or Sollet).

2. Create an Account

- If using a centralized exchange, sign up and complete KYC if required.

- For decentralized exchanges, set up a Phantom Wallet or Sollet Wallet for Solana-based token transactions.

3. Deposit Funds

- Centralized Exchange: You can deposit fiat currency (USD, EUR) or transfer cryptocurrencies like BTC, ETH, or USDT to your exchange account.

- Web3 Wallet: On Solana, you’ll need to deposit SOL (Solana’s native token) into your wallet, which you can then use to swap for ORCA.

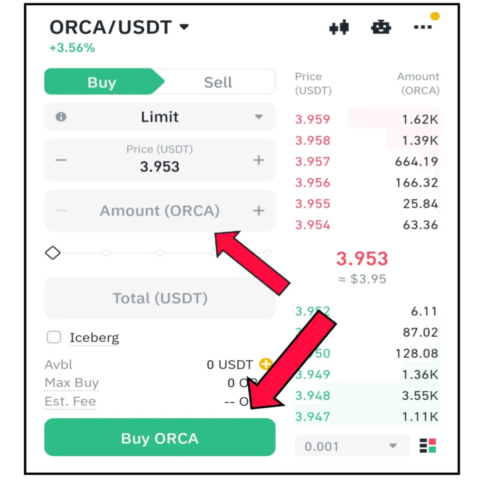

4. Buy ORCA

- Centralized Exchange: Use the ORCA/USDT or ORCA/ETH pairs to purchase ORCA on the exchange.

- Decentralized Exchange: After connecting your wallet to a DEX like Raydium, search for the ORCA token and trade your SOL or stablecoins for ORCA.

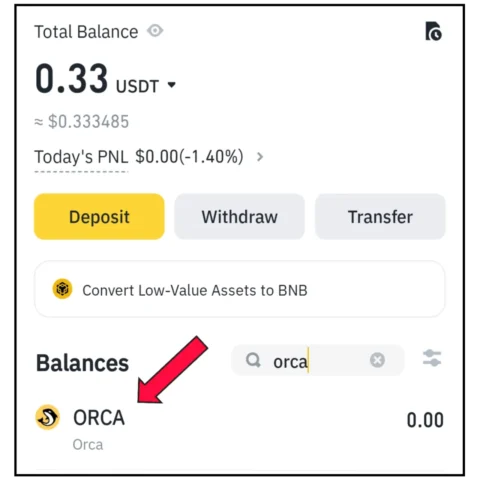

5. Store Your ORCA Tokens

- After purchasing, store your ORCA tokens in a secure wallet like Phantom (for Solana-based tokens) or a hardware wallet.

2. Understand the Risks Involved

Before investing, remember that investing in cryptocurrency involves high risks due to the volatility of the market.

- Volatility: Cryptocurrency prices can fluctuate dramatically, especially for DeFi tokens like GMX and ORCA.

- Regulatory Uncertainty: Regulatory changes can impact the value or availability of cryptocurrencies in certain regions.

- Security: Always use a secure wallet (like MetaMask or hardware wallets) to store your tokens safely. Never share your private keys or recovery phrases.

3. Staking and Earning Rewards

Both GMX and ORCA offer ways to earn passive income through staking and liquidity provision. You can participate in these programs to earn rewards:

- GMX Staking: Stake GMX tokens on the platform to earn a share of the fees generated from trading activity. Additionally, you can provide liquidity in various pairs to earn rewards.

- ORCA Staking: You can stake ORCA tokens directly or provide liquidity on DEXs like Raydium to earn rewards in the form of additional ORCA tokens or fees.

Before you stake, research the yields and risks associated with staking on each platform.

4. Monitor Your Investments

- Track the price of GMX and ORCA tokens using cryptocurrency tracking apps or portfolio management tools (such as CoinGecko, CoinMarketCap, or Delta).

- Stay updated on news about GMX and ORCA, particularly regarding platform updates, new partnerships, and general market trends.

Conclusion

To invest in GMX and ORCA coins:

- Choose a reliable exchange (centralized or decentralized) that supports the coins.

- Create an account on a CEX or set up a Web3 wallet for decentralized exchanges.

- Deposit funds in the form of fiat or cryptocurrencies (e.g., ETH, USDT, SOL).

- Buy GMX or ORCA on your chosen platform.

- Store your tokens in a secure wallet (preferably hardware wallets for long-term holding).

Additionally, always assess the associated risks and stay informed about both the platforms and market conditions to make well-informed decisions.

FAQs –

Q 1. What is the current price of GMX and ORCA coins?

Answer – 1. ORCA $3.957 2. GMX – $26.73

You can check the latest prices on cryptocurrency tracking platforms like CoinMarketCap or CoinGecko.

Q 2. How much money can you invest in GMX and ORCA coin?

Answer – The amount you can invest in GMX and ORCA coins depends on your personal financial situation, risk tolerance, and the platforms you are using. There is no fixed limit; however, consider starting with an amount you’re comfortable with, keeping in mind the volatility and risks of investing in cryptocurrencies. Always ensure you’re following any platform-specific guidelines and legal regulations in your region.

Q 3. When should we invest in GMX and ORCA coin?

Answer – The best time to invest in GMX and ORCA coins depends on market conditions, your financial goals, and risk tolerance. It’s generally ideal to invest during market dips or periods of low prices, but it’s important to conduct thorough research, consider long-term potential, and avoid trying to time the market perfectly. Diversifying your investments and using dollar-cost averaging can also help manage risk.

Conclusion –

In conclusion, both GMX and ORCA coins offer unique opportunities within the cryptocurrency and decentralized finance (DeFi) space. GMX stands out with its low-fee, high-liquidity perpetual and spot trading on Arbitrum and Avalanche blockchains, while also providing staking rewards and governance participation. On the other hand, ORCA offers a user-friendly decentralized exchange on the Solana blockchain, focusing on fast, low-fee token swaps and liquidity provision rewards.

However, like any cryptocurrency investment, both coins come with inherent risks due to market volatility and regulatory uncertainties. Investors should conduct thorough research, assess their risk tolerance, and stay informed about market trends.