WHAT IS MEME TOKEN : A meme token is a type of cryptocurrency that is typically created for fun or as part of a joke, often inspired by internet memes, trends, or popular culture. These tokens are usually not designed with serious investment purposes in mind, but they can gain significant attention due to their viral nature. Many meme tokens have started as a joke, but some have ended up with large communities and even market value, making them an interesting phenomenon in the crypto world.

Who Created The Meme Token First?

The first meme token is widely considered to be Dogecoin (DOGE), which was created in December 2013 by software engineers Billy Markus and Jackson Palmer.

Origins of Dogecoin:

- Creation: Dogecoin was initially created as a joke or parody based on the popular “Doge” meme, which featured a Shiba Inu dog with humorous captions written in Comic Sans font. The meme became widely popular on the internet around 2010, and the creators of Dogecoin decided to create a cryptocurrency based on this meme.

- Purpose: Markus and Palmer created Dogecoin as a lighthearted alternative to Bitcoin and other cryptocurrencies, with no serious intention of it becoming a major cryptocurrency. It was meant to be fun, approachable, and engaging, and was used largely for tipping content creators online, especially on platforms like Reddit and Twitter.

- Technology: Dogecoin was based on Luckycoin, which itself was derived from Litecoin. It used a proof-of-work algorithm similar to that of Bitcoin, but with a faster block time and an unlimited supply, differentiating it from Bitcoin, which has a capped supply.

Dogecoin’s Popularity and Legacy:

Though Dogecoin started as a joke, it quickly developed a dedicated and active community, and over the years, it gained a strong following. Celebrities like Elon Musk and online personalities helped fuel its rise in popularity. Dogecoin’s success sparked the creation of numerous other meme coins in the crypto space, leading to the development of meme tokens like Shiba Inu (SHIB), Floki Inu, and many others.

While Dogecoin remains the most famous meme token, it also helped popularize the meme token phenomenon in the broader cryptocurrency market. Its legacy is a testament to how internet culture and cryptocurrency can intersect in unexpected and often humorous ways.

Special Information About Meme Token

Key Characteristics of Meme Tokens:

- Humor and Virality: Meme tokens are often tied to internet memes, viral content, or popular culture figures. The most famous example, Dogecoin, was created as a parody of Bitcoin, featuring the popular “Doge” meme of a Shiba Inu dog.

- Community-Driven: The success of meme tokens is largely dependent on their community. These tokens typically rely on the enthusiasm and support of their followers to drive adoption, rather than any inherent technological innovation or use case.

- Low Utility: Most meme tokens lack significant practical use or utility. They are often used as a fun, speculative asset rather than for specific, real-world applications.

- Highly Volatile: Due to their speculative nature and reliance on trends and hype, meme tokens can experience extreme price fluctuations. Their value is often driven by social media trends, celebrity endorsements, and internet memes.

Popular Meme Tokens:

- Dogecoin (DOGE): Originally created as a joke, Dogecoin has become one of the most well-known meme tokens. It has gained popularity through endorsements from celebrities like Elon Musk.

- Shiba Inu (SHIB): Often referred to as the “Dogecoin killer,” SHIB is another meme-inspired cryptocurrency.

- Pepe Coin (PEPE): Inspired by the “Pepe the Frog” meme, this token is another example of meme culture entering the crypto space.

Why Do People Buy Meme Tokens?

- Speculation: Some people buy meme tokens in the hope that their value will rise quickly due to viral trends or social media buzz.

- Community and Fun: Others buy meme tokens because they enjoy being part of a fun and engaging community.

- FOMO (Fear of Missing Out): Many people get involved in meme tokens because they fear missing out on potential large profits, as the price can sometimes increase rapidly based on hype.

Risks of Meme Tokens:

- Volatility: Meme tokens can be very volatile, with prices often spiking and crashing quickly.

- Lack of Long-Term Value: Many meme tokens don’t have significant use cases or long-term potential, making them high-risk investments.

- Scams and “Pump-and-Dump” Schemes: Some meme tokens are created by bad actors who manipulate prices for short-term gain, often leaving investors with significant losses.

In summary, meme tokens are cryptocurrencies inspired by internet culture and memes, often with no serious utility. They rely on viral trends, community support, and speculation, but come with high risk due to their lack of inherent value or stability.

What Are The Benefits of MEME Token?

While meme tokens are often associated with humor, viral trends, and high volatility, there are still some potential benefits that come with investing in or using them. Here are some of the benefits:

1. Community Engagement and Fun

- Entertainment and Social Interaction: Meme tokens often have strong, passionate communities built around them. These communities can be fun and engaging, where people share memes, jokes, and experiences, creating a sense of belonging.

- Viral Trends: Since meme tokens are driven by social media and internet trends, they offer an opportunity to participate in something viral or culturally significant. Some people enjoy the excitement and energy that come with being part of a meme-based movement.

2. Low Entry Cost

- Affordable Investment: Many meme tokens are priced very low, meaning that they can be purchased in large quantities for a relatively small amount of money. This low entry point might attract people who are interested in experimenting with cryptocurrencies but don’t have much capital to invest in established coins like Bitcoin or Ethereum.

- Accessible to New Investors: For newcomers to crypto, meme tokens can act as an introduction to the world of digital currencies without requiring significant initial investment.

3. Potential for High Returns (Speculation)

- Viral Price Spikes: Meme tokens have seen extraordinary price increases in short timeframes due to viral moments or celebrity endorsements (e.g., Elon Musk’s tweets about Dogecoin). These price surges can lead to substantial profits for early investors or those who time the market well.

- Speculative Opportunities: Investors who get in at the right time and ride the hype wave can make significant returns. Many investors buy meme tokens with the hope that they will catch the next big surge.

4. Low-Cost Experimentation and Innovation

- Experimentation with New Ideas: Some meme tokens serve as experiments for new ideas in the cryptocurrency world. These could include creative ways of building communities, raising funds for causes, or exploring new tokenomics (economic models) without the pressure of needing to be a serious or “traditional” crypto project.

- Learning Tool: For those interested in learning about cryptocurrency, meme tokens can serve as a low-risk way to explore blockchain technology, wallets, exchanges, and other aspects of the crypto ecosystem.

5. Charity and Community Fundraising

- Charitable Donations: Some meme token projects (like Dogecoin) have been used to raise funds for charitable causes. The communities behind these tokens sometimes organize events or campaigns to donate a portion of the token’s value to charity, allowing people to contribute to good causes while having fun.

- Fundraising for Other Projects: Meme tokens are sometimes used to fund other creative or community-driven projects. These funds can be used for art, memes, or other community-driven initiatives.

6. Increased Visibility for the Crypto Market

- Wider Awareness: Meme tokens help increase awareness of cryptocurrencies in general, especially among younger audiences or those who may not otherwise be interested in traditional financial investments. When a meme coin goes viral, it brings attention to the broader cryptocurrency space.

- Mainstream Exposure: With celebrity endorsements or viral social media moments, meme tokens can bring crypto into mainstream discussions and spark interest in the market, driving new participants to explore other digital assets.

7. Decentralization and Freedom

- Community Control: Many meme tokens are decentralized, meaning they are not controlled by a central authority or corporation. The communities around these tokens often have a significant say in how the project evolves, whether through governance tokens or community votes.

- Freedom to Participate: Anyone can buy, hold, or trade meme tokens without needing permission from any central entity, making it accessible to a wide range of people globally.

Conclusion:

While meme tokens are primarily speculative and volatile, they can offer a variety of benefits such as entertainment, community engagement, low-cost investment opportunities, and the potential for high returns during periods of hype. They also serve as an entry point into the cryptocurrency world, allowing individuals to experiment with digital assets in a fun and relatively low-risk manner. However, the high volatility and lack of inherent utility mean that meme tokens should be approached with caution, and investors should be aware of the risks involved.

What are the disadvantages of MEME Token?

While meme tokens can offer some fun and speculative opportunities, they come with several significant disadvantages and risks. Here are the main downsides to consider:

1. High Volatility and Speculation

- Extreme Price Fluctuations: Meme tokens are known for their high volatility. Their prices can spike quickly based on trends, memes, or social media mentions, but they can just as easily crash. This makes them risky investments, as their value often has little to do with fundamental or technological factors.

- Pump-and-Dump Schemes: Meme tokens are susceptible to “pump-and-dump” schemes, where the price is artificially inflated by a group of people or coordinated efforts, and then crashes once the hype dies down. This can lead to significant financial losses for those who buy in during the “pump.”

2. Lack of Utility or Real-World Use

- No Inherent Value: Many meme tokens lack a clear use case or real-world utility. Unlike more established cryptocurrencies like Bitcoin or Ethereum, which have functions such as acting as a store of value or enabling decentralized applications, meme tokens are often created purely for entertainment or as a joke. This lack of utility makes them speculative assets at best.

- Unclear Long-Term Viability: Because meme tokens are typically created as part of a joke or viral trend, they often lack long-term development goals or sustainability plans. As a result, many of these tokens may disappear or lose value once the trend fades or the community loses interest.

3. Risk of Scams and Fraud

- Scams and Rug Pulls: Due to the lack of regulation and oversight in the cryptocurrency space, meme tokens are vulnerable to scams. Some developers may launch a meme token, hype it up to increase its value, and then “pull the rug” by abandoning the project or stealing investors’ funds.

- Unverified Projects: Many meme token projects are launched with minimal information, and their teams may not be transparent. This increases the risk of fraudulent schemes, where the project’s creators could disappear after collecting funds without delivering on any promises.

4. Lack of Regulation

- Unregulated Market: The meme token market, like much of the cryptocurrency space, is largely unregulated. This lack of regulation can lead to price manipulation, fraudulent activity, and a general lack of consumer protection for investors.

- Legal Uncertainty: In many jurisdictions, the legal status of meme tokens and their regulatory framework is unclear. This uncertainty can create challenges for investors and developers, especially if meme tokens are later classified as securities or face legal scrutiny.

5. Social Media Dependency

- Viral Nature Can Fade: Meme tokens often depend heavily on social media trends and viral campaigns for their value. If the token or meme loses popularity or a major influencer stops promoting it, the value can quickly drop. This makes meme tokens highly susceptible to the fickle nature of internet trends.

- Influence of Celebrities: The price of meme tokens can be dramatically affected by the endorsement or actions of celebrities (like Elon Musk with Dogecoin). This can create a situation where the token’s value is driven by external personalities rather than actual market fundamentals, which can be risky.

6. FOMO and Emotional Investment

- Fear of Missing Out (FOMO): Many investors are drawn to meme tokens due to the fear of missing out on potential gains if the token.

- Hype-Driven Decisions: The community-driven nature of meme tokens often results in people making purchases based on hype or excitement rather than any meaningful information about the project’s viability or future.

7. Market Saturation

- Too Many Tokens: There are now thousands of meme tokens in circulation, making it difficult to differentiate between legitimate, promising projects and those that are simply capitalizing on a fleeting trend. This oversaturation of the market can make it harder for meme tokens to stand out or gain lasting value.

- Confusion and Dilution: The existence of so many meme tokens with similar themes (e.g., Dogecoin, Shiba Inu, Floki Inu, etc.) can dilute interest and investment, reducing the potential for any one token to achieve long-term success.

8. Environmental Impact

- Energy Consumption: Although this is more of an issue with proof-of-work cryptocurrencies like Bitcoin, some meme tokens that use similar consensus mechanisms can contribute to high energy consumption and environmental impact. This can be a concern for eco-conscious investors.

Conclusion:

These include high volatility, a lack of real-world utility, potential for scams, and market manipulation. Investors should be cautious and aware that meme tokens are speculative assets, often driven by trends and social media, rather than by solid fundamentals. As with any investment, it’s important to carefully evaluate the risks and do thorough research before getting involved.

How To Earn Money From Meme Token

Earning money from meme tokens is speculative and high-risk, but there are several ways to potentially profit from them. Here’s how you can earn money from meme tokens, along with a brief overview of the associated risks:

1. Buying and Holding (HODLing)

- How It Works: The simplest way to earn money from meme tokens is by purchasing them at a low price and holding them in hopes that their value will increase over time. The idea is to sell them when the price rises, ideally at a higher value than when you bought them.

- Strategy:

- Buy meme tokens when the price is low or during early stages of hype.

- Wait for a price increase due to viral trends, celebrity endorsements, or community momentum.

- Sell when the price peaks or when you believe the token has reached its maximum value.

- Risks: Meme tokens are volatile, and their prices can drop just as quickly as they rise. Predicting when to buy or sell can be difficult, as prices often depend on social media trends or sudden bursts of interest.

2. Participating in Token Airdrops

- How It Works: Sometimes, meme token projects distribute free tokens through airdrops to raise awareness or reward their community. Airdrops can be a way to get meme tokens without purchasing them.

- Strategy:

- Stay active in meme token communities, especially on social media platforms like Twitter, Reddit, or Telegram, where airdrop announcements are made.

- Sign up for airdrop programs from meme token projects that are distributing free tokens to early adopters or active participants.

- Risks: Many airdrops require sharing personal information or engaging in activities that could lead to scams. Be cautious of fraudulent projects that promise airdrops but end up being scams or “rug pulls.”

3. Staking Meme Tokens

- How It Works: Some meme tokens may offer a staking feature, where you can lock up your tokens in a wallet to help secure the network or participate in the token’s ecosystem. In return, you can earn additional tokens as rewards.

- Strategy:

- Check if the meme token offers a staking program, either through its official platform or through third-party DeFi platforms.

- Stake your tokens to earn rewards over time. This can help generate passive income from meme tokens you already own.

- Risks: Staking can be risky, especially with meme tokens, as their value can fluctuate wildly. Additionally, some staking platforms or protocols might have security vulnerabilities, or the token may lose value during the staking period.

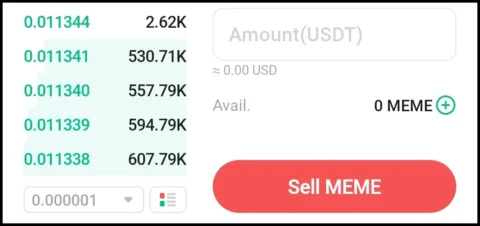

4. Trading Meme Tokens

- How It Works: Day trading or swing trading meme tokens involves buying and selling them in short time frames to profit from price movements. This method requires technical analysis, market knowledge, and a good understanding of the trends driving the meme token market.

- Strategy:

- Buy meme tokens during dips or corrections when the price is low, then sell when the price rises.

- Use technical indicators, such as moving averages and relative strength index (RSI), to make informed decisions.

- Monitor social media for signs of rising interest in a meme token that could lead to price increases.

- Risks: Trading meme tokens is risky because their prices are often driven by hype and trends, making it difficult to predict price movements accurately. There is also a higher risk of losing money if you don’t time the market well.

5. Creating and Selling Meme Token Projects

- How It Works: If you have the skills to develop a meme token, you can create your own token and launch it to the market. You can sell the tokens you create, profit from trading fees, or even launch a project with a strong community behind it.

- Strategy:

- Create a meme token that resonates with internet culture or a viral trend.

- Develop a strong social media presence and build a community around the token to drive its value.

- Offer incentives for people to buy or use your token, such as staking rewards or special perks.

- Risks: Creating a meme token can be challenging and resource-intensive. It also carries significant legal and financial risks, especially if the project isn’t transparent or falls prey to scams. Many meme tokens fail to gain traction or eventually fade away.

6. Participating in Meme Token Ecosystem (Tipping, Donations, and Merchandise)

- How It Works: Some meme tokens are used for tipping, donations, or merchandise purchases. By actively participating in these ecosystems, you might earn or spend meme tokens in exchange for goods, services, or support.

- Strategy:

- Join online communities where meme tokens are used for tipping content creators or rewarding others.

- Participate in charitable campaigns or giveaways involving meme tokens.

- Use meme tokens to buy merchandise or other assets within the token’s ecosystem to help increase its value and circulation.

- Risks: The rewards from these ecosystems can be minimal, and the value of the tokens you earn might not hold up over time, especially if the community or project loses interest.

7. NFT Integration

- How It Works: Some meme tokens may integrate with NFTs (Non-Fungible Tokens), where token holders can participate in NFT projects or use their tokens to buy exclusive NFTs (such as meme-inspired digital art).

- Strategy:

- Invest in meme tokens that are linked to NFTs, hoping that the NFT market will grow and increase the value of both the meme token and its associated digital assets.

- Buy meme-themed NFTs early on, with the expectation that their value will increase as interest in the meme token rises.

- Risks: NFT markets are volatile, and meme-based NFTs may not always hold long-term value. The value of NFTs is often speculative, and prices can drop quickly.

Important Risks to Keep in Mind:

- High Volatility: Meme tokens are notoriously volatile, with prices that can fluctuate wildly. You might see large gains, but equally large losses are common.

- Lack of Real Utility: Many meme tokens have little to no inherent value beyond speculation and social media hype. This makes them a risky investment.

- Scams and Rug Pulls: Some meme tokens are created with the intent of defrauding investors, known as “rug pulls.” Always research the legitimacy of a meme token project before getting involved.

- Market Sentiment: Meme tokens are often driven by hype and trends, so their value can be significantly affected by social media, celebrity endorsements, or sudden drops in interest.

Conclusion:

While earning money from meme tokens is possible, it requires careful research, timing, and risk management. The most common strategies include buying and holding, participating in airdrops, trading, staking, or even creating your own token. However, it’s important to remember that meme tokens are highly speculative, and there are significant risks involved, including the potential for substantial losses. Always approach meme tokens with caution and only invest what you can afford to lose.

How To Invest In Meme Token

Investing in meme tokens involves the same basic principles as investing in any other cryptocurrency, but with added caution due to their speculative and often volatile nature. Here’s a step-by-step guide on how to invest in meme tokens:

1. Do Your Research

- Understand the Token: Research the meme token you’re interested in. Look for its whitepaper (if available), check out the development team’s background, and analyze its community support and social media presence. Given the speculative nature of meme tokens, community engagement is often a key factor in their success.

- Evaluate Its Utility: While meme tokens typically have limited real-world utility, it’s still important to understand how the token functions. Does it have a clear use case, or is it just a speculative asset driven by social media trends?

- Check for Red Flags: Be cautious of scams or “rug pulls” — situations where the creators of a token abandon the project after inflating its price. Look for transparent information about the project’s goals, roadmap, and team.

2. Set Up a Cryptocurrency Wallet

- Choose a Wallet: You’ll need a wallet to store your meme tokens. Options include software wallets (e.g., MetaMask, Trust Wallet) and hardware wallets (e.g., Ledger, Trezor) for better security.

- Set Up the Wallet: After selecting a wallet, follow the instructions to set it up and securely store your recovery phrase. This phrase will be essential if you ever lose access to your wallet.

- Add Meme Tokens to Your Wallet: Some meme tokens may not be readily available in default wallets. In this case, you’ll need to add the custom token by entering its contract address.

3. Choose a Cryptocurrency Exchange

- Centralized Exchanges: Many meme tokens, especially popular ones like Dogecoin (DOGE) and Shiba Inu (SHIB), can be bought directly on major cryptocurrency exchanges, such as:

- Binance

- Coinbase

- Kraken

- KuCoin

- Decentralized Exchanges (DEXs): Some meme tokens, particularly lesser-known ones, may not be listed on major exchanges. In this case, you can use a decentralized exchange like:

- Uniswap (for ERC-20 tokens)

- SushiSwap

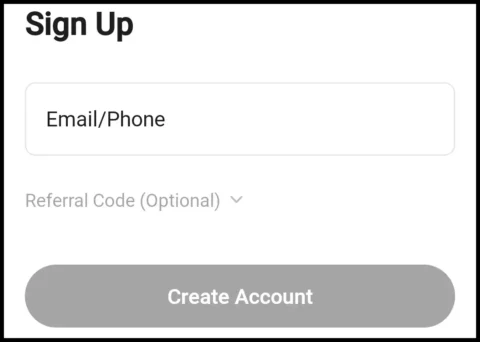

- Create an Account: On centralized exchanges, create an account and complete any required KYC (Know Your Customer) verification process.

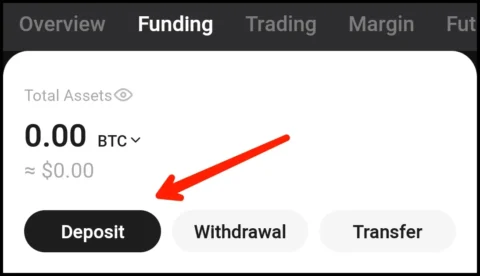

4. Deposit Funds Into Your Account

- Deposit Fiat or Cryptocurrency: Most exchanges allow you to deposit fiat currency (USD, EUR, etc.) via bank transfer, credit card, or other payment methods. You can also deposit cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH) if you already hold some.

- Convert Funds into Cryptocurrency: If your funds are in fiat, you will need to buy a base cryptocurrency like Bitcoin (BTC) or Ethereum (ETH) first, as many meme tokens are traded in pairs with these major coins. If you’re on a decentralized exchange, you may need to first convert your fiat or base coin into Ethereum (ETH) or Binance Coin (BNB), depending on the token’s blockchain.

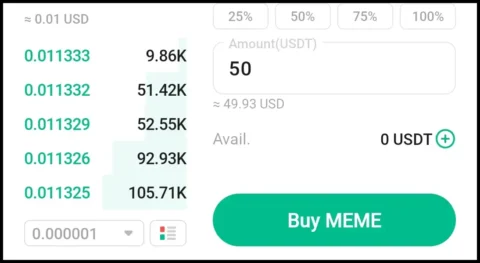

5. Buy Meme Tokens

- Search for the Meme Token: On the exchange, search for the meme token you wish to buy (e.g., Dogecoin, Shiba Inu, or any other meme coin). Make sure you are on the correct token’s page by verifying its contract address, especially for lesser-known meme tokens.

- Place an Order: On centralized exchanges, you can buy meme tokens directly using market orders (buying at the current price) or limit orders (setting a price at which you’re willing to buy). On decentralized exchanges (DEXs), you will need to connect your wallet (e.g., MetaMask) and swap your cryptocurrency for the meme token.

- Transaction Fees: On DEXs, fees can vary based on network congestion, especially for Ethereum-based tokens.

6. Transfer Meme Tokens to Your Wallet

- Security: After purchasing the meme tokens, it’s generally safer to transfer them from the exchange to your private wallet (e.g., MetaMask, Trust Wallet) rather than leaving them on the exchange, where they could be vulnerable to hacks or exchange closures.

- Withdraw to Your Wallet: Go to your exchange’s withdrawal section, enter your wallet address, and withdraw the tokens to your wallet.

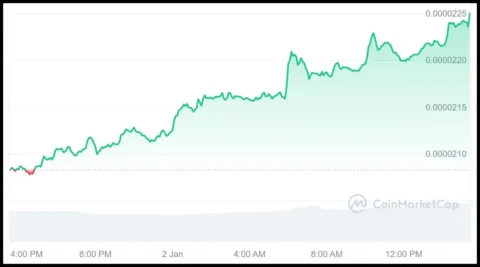

7. Monitor Your Investment

- Track the Token’s Performance: Use cryptocurrency tracking tools like CoinGecko, CoinMarketCap, or the wallet’s built-in tools to monitor the price and overall performance of your meme token.

- Stay Active in the Community: Meme tokens often depend on community activity and social media buzz. Stay active in the communities (e.g., Reddit, Telegram, Twitter) to track news, trends, and potential upcoming events that could affect the value of your tokens.

8. Have an Exit Strategy

- Know When to Sell: Meme tokens are highly speculative and volatile, so it’s essential to have an exit strategy.

- Profit Goals: Sell once the token reaches a certain profit level.

- Stop-Loss Orders: Set a stop-loss order to limit potential losses if the price of the token drops too far.

- Sell on Exchanges: To sell your meme tokens, go to the exchange where you bought them (or a different exchange that supports the token) and sell them for another cryptocurrency or fiat currency.

9. Tax Considerations

- Cryptocurrency Taxes: In many countries, profits from cryptocurrency trading are taxable. Keep track of your trades, and consult a tax professional to ensure you comply with local tax laws regarding cryptocurrency earnings.

Tips for Investing in Meme Tokens:

- Start Small: Meme tokens can be highly speculative, so consider starting with a small investment that you can afford to lose.

- Stay Informed: Meme tokens are driven by internet trends and social media. Follow relevant forums, communities, and influencers to stay updated on the latest developments.

- Beware of Scams: Be cautious of new meme tokens that promise unrealistically high returns or lack transparency. Always double-check contract addresses to avoid fraud.

- Diversify: Don’t put all your funds into meme tokens. Diversifying your investment portfolio with more stable cryptocurrencies or traditional assets is a good strategy to reduce risk.

Conclusion:

Investing in meme tokens can be exciting and potentially profitable, but it comes with significant risks due to their volatility and speculative nature. By following the steps above—doing your research, choosing the right platform, securing your assets, and monitoring the market—you can participate in meme token investing responsibly. However, always remember to invest only what you can afford to lose and stay cautious of the hype-driven nature of these tokens.

FAQs –

Q 1. What are the meme tokens we can invest in now?

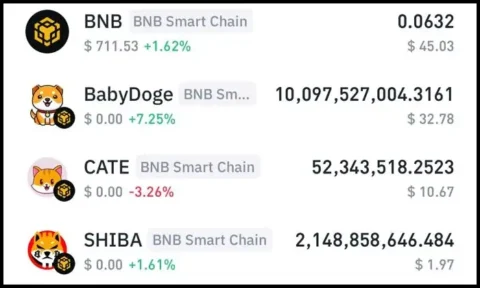

Answer – Some popular meme tokens you can invest in now include:

- Dogecoin (DOGE)

- Shiba Inu (SHIB)

- Floki Inu (FLOKI)

- DogeCoin Millionaire (DCM)

- Kishu Inu (KISHU)

- Baby Doge Coin (BABYDOGE)

- Hoge Finance (HOGE)

Remember to conduct thorough research before investing, as meme tokens are highly speculative and volatile.

Q 2. What is the minimum age required to invest in meme token?

Answer – The minimum age required to invest in meme tokens is typically 18 years old, as this is the legal age to enter into contracts and make investments in most countries. However, this can vary depending on local laws and the platform you’re using.

Conclusion –

In conclusion, meme tokens are a highly speculative and volatile segment of the cryptocurrency market. While they can offer opportunities for quick profits driven by community hype, social media trends, and celebrity endorsements, they come with significant risks, including extreme price fluctuations, scams, and a lack of real-world utility. Investing in meme tokens requires careful research, a clear understanding of the risks, and an awareness that these tokens are often driven by speculation rather than fundamental value. As with any investment, it’s important to only invest what you can afford to lose and to approach meme tokens with caution and a well-thought-out strategy.